by Susanna GotschSenior Director, Industry AnalystOver the last several years, the collision repair industry, like many, has faced numerous challenges: keeping employees safe during the pandemic while remaining open as essential businesses; parts and material shortages; staffing challenges; meeting the growing demand for training and tooling to support the repair of an increasingly complex vehicle fleet; and increased demand among customers for a digitized experience.CCC estimates the collision repair industry processes approximately $55 billion in repairs annually. Repair volumes remain down (between 5% and 10% versus pre-pandemic levels), but higher repair costs per vehicle have resulted in further industry growth. Consolidation has also affected the estimated 41,000 collision repair locations (including approximately 6K dealer shops and 35K independents) in the U.S.[1] In fact, overall growth within the segment over the last fifteen years has seen a compound annual growth rate of -0.5 percent.[2]Nearly 90 percent of the collision repair industry revenue is from insurance-paid work, where the customer has made an insurance claim, while the remaining 10 percent is consumer-paid with no insurance claim.[3] Pre-COVID-19, CCC estimates that just over 22 million vehicles had an auto claim annually in the U.S.

Work Backlog and Technician Shortages

As repair volumes continue to build towards pre-COVID levels, industry-wide capacity is being pushed to the brink. According to surveys conducted by CRASH Network, nearly all shops reported significant increases in their backlog of work, with 85 percent reporting they are scheduling new work two weeks or more into the future. This work backlog is expected to remain at its highest point in the past six years (Figure 1).

The key issues driving that backlog are parts availability and shortage of technicians. Supply chain disruptions continue to plague many industries, leaving shops waiting weeks to months for certain parts. Several large suppliers are now reporting some modest improvements in fill rates as the volume of parts being shipped from places like Taiwan has grown,[4] but challenges remain.According to the TechForce Foundation’s 2021 Report, the overall number of collision technicians has fallen from 160,400 in 2016 to 153,700 in 2020.[5] Retirement of baby boomers, transfers and turnovers, as well as new positions will create demand for over 19,000 collision technicians annually between 2021 and 2025.[6] To attract more talent to fill those roles, shops have been looking at adjusting wages. Over the last decade, the repair industry has seen smaller increases than other similar occupations (Figure 2).

For example, data from the Bureau of Labor Statistics Occupational Outlook Handbook projects only 3 percent growth in the number of automotive body and glass repairers between 2021 and 2031 versus 5 percent across all occupations.[7]The bottom line is that the technician shortage is not a short-term issue for repairers, but rather one that will drag on industry capacity for years to come. With shops competing for a smaller number of technicians while repair volumes are building, many shops have indicated they cannot repair as many vehicles at the same time as they did before the pandemic.

Time Continues to be a Scarce Resource

While repairers continue to see an elevated number of non-driveable DRP repairs (Figure 3), both driveable and non-driveable repairs are taking longer (Figure 4), and repairer productivity is lower (Figure 5).Rising repair costs from greater vehicle complexity and inflation in parts and labor have shifted more of the repair volume into higher repair dollar brackets – between mid-year 2017 and mid-year 2022 there has been an 11.4 percent point increase in repair volume averaging more than $5,000 (Figure 6). Unfortunately, as repair costs climb, repairer productivity can sometimes suffer, customer satisfaction can fall, and the likelihood that the customer needs to bring their vehicle back for additional work after repairs are completed also increases (Figure 7).

And it’s not just repair time that is taking longer. Claimants are taking longer to report their loss, and the average number of days from when the loss is reported to when the assignment for an estimate is made has also grown (Figure 8). The time from the last assignment to when the estimate is completed and uploaded has also grown as repairers and insurers struggle with capacity and a higher volume of non-driveable losses (Figure 9).There is a bright side, though. Appraisals generated via photo estimating saw an improvement in days from last assignment sent to estimate sent. With photo estimating, insurers can continue to provide customers with their initial appraisal and the information they need to make decisions much faster. And photo estimating usage continues to see strong adoption (Figure 10).Further driving up overall claim cycle time is the growth in the number of days from when a customer has their estimate to when they can bring their vehicle in for repairs (Figure 11). All combined, the average number of days from when a loss is reported to when the vehicle is picked up after repair has grown to nearly 50 days (Figure 12).

How Shops Bring in Business is Shifting

With constrained capacity in the collision repair industry, repairers are reducing the number of Open Shop and direct repair programs in which they participate. In 2021 the average number of insurer programs in which individual repairers participated, either as part of an insurer’s Open Shop or DRP began to fall (Figure 13). DRP program participation has fallen most for repairers that are part of a National MSO (Figure 14). Despite this drop in program participation, National MSO share of overall DRP volume continues to grow (Figure 15).

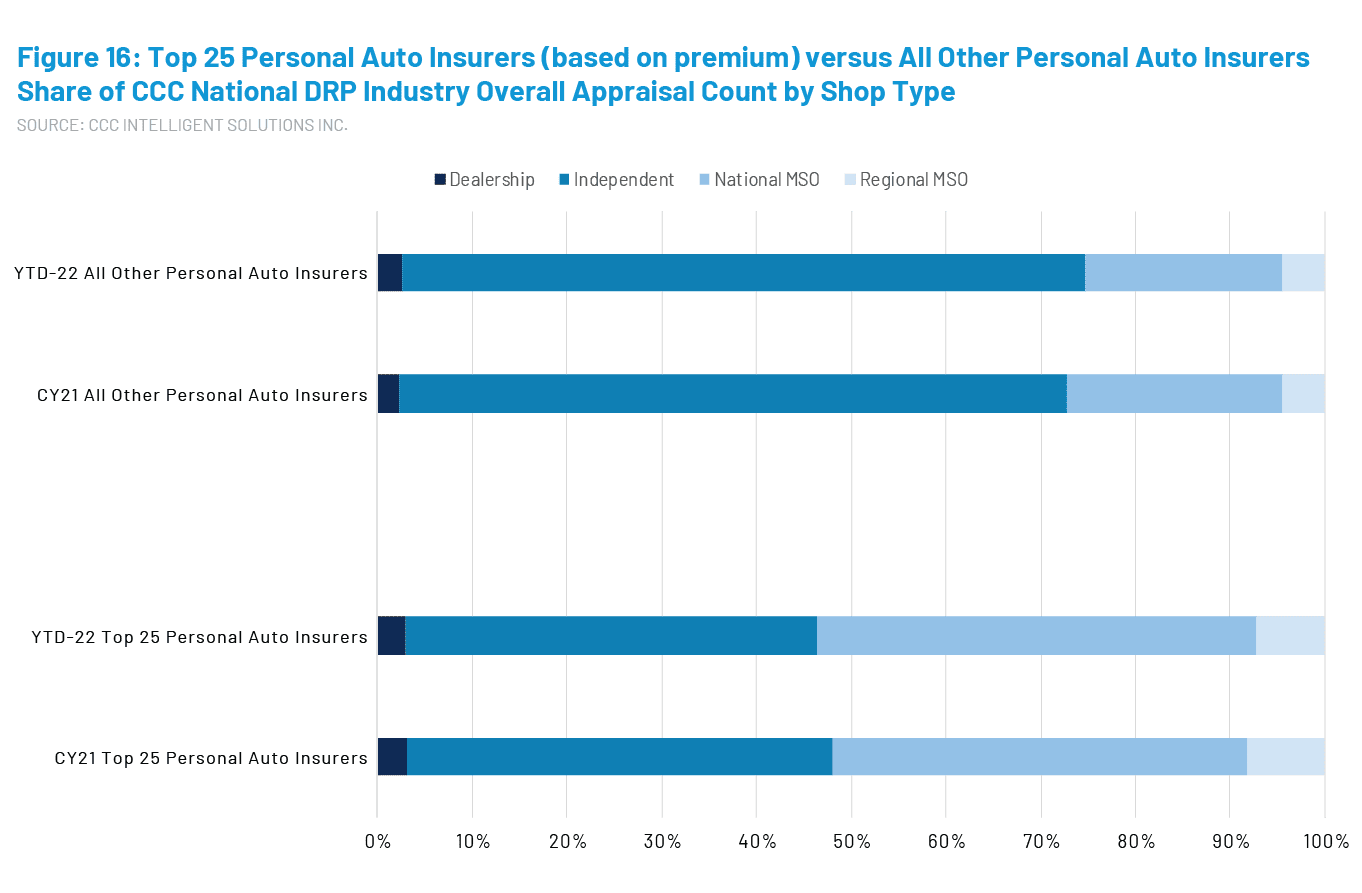

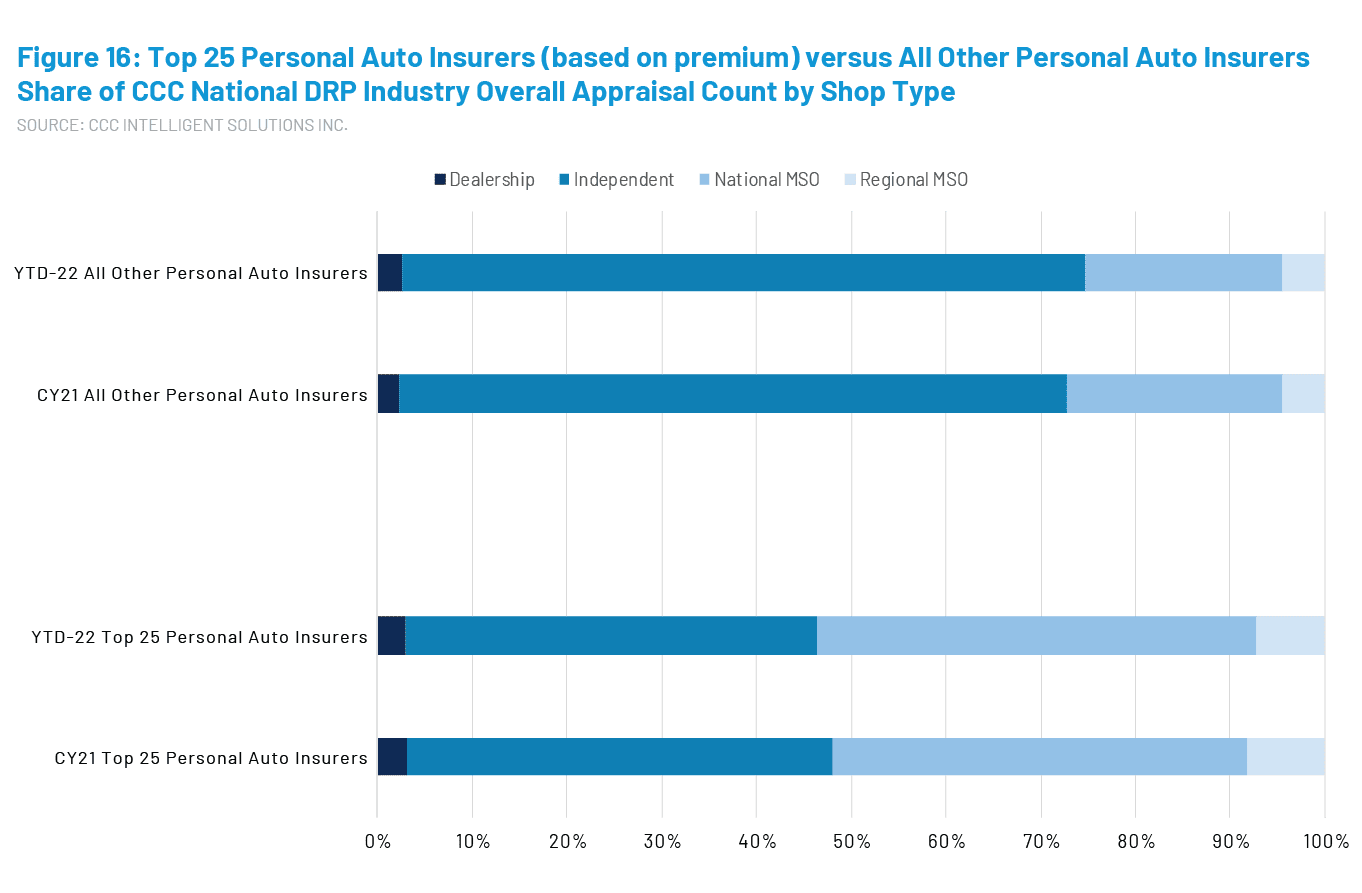

When you divide DRP appraisals into two groups – volume from the top 25 insurers versus volume from all other personal auto insurers - and then divide it one more time by shop type, we found that National MSO’s share of volume for the largest carriers is significantly higher than for the remaining carriers. On the other hand, independents’ had the lion’s share of share of DRP volume for carriers outside the top 25 at 72 percent (Figure 16).

But the top 25 insurance carriers will still take the bulk of the market share. Last year, 88 percent Market of U.S. auto insurance direct premiums were underwritten by the top 25 carriers (see Figure 17). On the repair shop side, over 40 percent of 2020’s total repair industry revenue came from shops that had over $10M in annual shop revenue.[8] And, big MSOs appear to also be getting bigger – more than 327 rooftops were acquired in the last two years.[9]

As auto accident frequency continues its recovery to pre-pandemic levels, many of the industry’s challenges still exist. Understanding your individual market conditions, and the potential requirements specific to the vehicles each repairer is most likely to see, and the deciding where to invest in training and tools has become more challenging and expensive. To “win” in 2023, shops should continue to adapt their businesses to address the consumer and market demands, understand the changing and complex vehicle technology, and focus on employee engagement.The information and opinions in this publication are for general information only, are subject to change and are not intended to provide specific recommendations for any individual or entity. Although information contained herein has been obtained from sources believed to be reliable, CCC does not guarantee its accuracy and it may be incomplete or condensed. CCC is not liable for any typographical errors, incorrect data and/or any actions taken in reliance on the information and opinions contained in this publication. Note: Where CCC Information Services Inc. is cited as source, the data provided is an aggregation of industry data related to electronic appraisals communicated via CCC's electronic network or from total loss valuations processed by CCC. [1] CRASH Network. “U.S. has fewer – but larger – shops.” May 23, 2022, Volume 29, No. 19. NADA Data 2021.[2] Auto Care Association. “Auto Care Factbook 2020.” Page 55. Bethesda, MD: 2020.[3] Vincent Romans. “Advancing Our Insights Into The Collision Repair Marketplace.” MSO Symposium presentation, Las Vegas, NV, November 4, 2019[4] Seeking Alpha. “LKQ Corp (LKQ) Q2 Earnings Conference Call July 28, 2022 8:00 AM ET.”[5] TechForce Foundation. “2021 Report” Transportation Technician Supply & Demand.”[6] Ibid.[7] CollisionWeek. “U.S. Department of Labor Projects Auto Body and Glass Employment to Increase Just 3% by 2031.” September 9, 20222.[8] Vincent Romans. MSO Symposium presentation, Las Vegas, NV, November 1, 2021.[9]https://www.autobodynews.com/index.php/industry-news/item/25219-2021-a-busy-year-of-collision-repair-acquisitions.html.

by Susanna GotschSenior Director, Industry AnalystOver the last several years, the collision repair industry, like many, has faced numerous challenges: keeping employees safe during the pandemic while remaining open as essential businesses; parts and material shortages; staffing challenges; meeting the growing demand for training and tooling to support the repair of an increasingly complex vehicle fleet; and increased demand among customers for a digitized experience.CCC estimates the collision repair industry processes approximately $55 billion in repairs annually. Repair volumes remain down (between 5% and 10% versus pre-pandemic levels), but higher repair costs per vehicle have resulted in further industry growth. Consolidation has also affected the estimated 41,000 collision repair locations (including approximately 6K dealer shops and 35K independents) in the U.S.[1] In fact, overall growth within the segment over the last fifteen years has seen a compound annual growth rate of -0.5 percent.[2]Nearly 90 percent of the collision repair industry revenue is from insurance-paid work, where the customer has made an insurance claim, while the remaining 10 percent is consumer-paid with no insurance claim.[3] Pre-COVID-19, CCC estimates that just over 22 million vehicles had an auto claim annually in the U.S.

Work Backlog and Technician Shortages

As repair volumes continue to build towards pre-COVID levels, industry-wide capacity is being pushed to the brink. According to surveys conducted by CRASH Network, nearly all shops reported significant increases in their backlog of work, with 85 percent reporting they are scheduling new work two weeks or more into the future. This work backlog is expected to remain at its highest point in the past six years (Figure 1).

The key issues driving that backlog are parts availability and shortage of technicians. Supply chain disruptions continue to plague many industries, leaving shops waiting weeks to months for certain parts. Several large suppliers are now reporting some modest improvements in fill rates as the volume of parts being shipped from places like Taiwan has grown,[4] but challenges remain.According to the TechForce Foundation’s 2021 Report, the overall number of collision technicians has fallen from 160,400 in 2016 to 153,700 in 2020.[5] Retirement of baby boomers, transfers and turnovers, as well as new positions will create demand for over 19,000 collision technicians annually between 2021 and 2025.[6] To attract more talent to fill those roles, shops have been looking at adjusting wages. Over the last decade, the repair industry has seen smaller increases than other similar occupations (Figure 2).

For example, data from the Bureau of Labor Statistics Occupational Outlook Handbook projects only 3 percent growth in the number of automotive body and glass repairers between 2021 and 2031 versus 5 percent across all occupations.[7]The bottom line is that the technician shortage is not a short-term issue for repairers, but rather one that will drag on industry capacity for years to come. With shops competing for a smaller number of technicians while repair volumes are building, many shops have indicated they cannot repair as many vehicles at the same time as they did before the pandemic.

Time Continues to be a Scarce Resource

While repairers continue to see an elevated number of non-driveable DRP repairs (Figure 3), both driveable and non-driveable repairs are taking longer (Figure 4), and repairer productivity is lower (Figure 5).Rising repair costs from greater vehicle complexity and inflation in parts and labor have shifted more of the repair volume into higher repair dollar brackets – between mid-year 2017 and mid-year 2022 there has been an 11.4 percent point increase in repair volume averaging more than $5,000 (Figure 6). Unfortunately, as repair costs climb, repairer productivity can sometimes suffer, customer satisfaction can fall, and the likelihood that the customer needs to bring their vehicle back for additional work after repairs are completed also increases (Figure 7).

And it’s not just repair time that is taking longer. Claimants are taking longer to report their loss, and the average number of days from when the loss is reported to when the assignment for an estimate is made has also grown (Figure 8). The time from the last assignment to when the estimate is completed and uploaded has also grown as repairers and insurers struggle with capacity and a higher volume of non-driveable losses (Figure 9).There is a bright side, though. Appraisals generated via photo estimating saw an improvement in days from last assignment sent to estimate sent. With photo estimating, insurers can continue to provide customers with their initial appraisal and the information they need to make decisions much faster. And photo estimating usage continues to see strong adoption (Figure 10).Further driving up overall claim cycle time is the growth in the number of days from when a customer has their estimate to when they can bring their vehicle in for repairs (Figure 11). All combined, the average number of days from when a loss is reported to when the vehicle is picked up after repair has grown to nearly 50 days (Figure 12).

How Shops Bring in Business is Shifting

With constrained capacity in the collision repair industry, repairers are reducing the number of Open Shop and direct repair programs in which they participate. In 2021 the average number of insurer programs in which individual repairers participated, either as part of an insurer’s Open Shop or DRP began to fall (Figure 13). DRP program participation has fallen most for repairers that are part of a National MSO (Figure 14). Despite this drop in program participation, National MSO share of overall DRP volume continues to grow (Figure 15).

When you divide DRP appraisals into two groups – volume from the top 25 insurers versus volume from all other personal auto insurers - and then divide it one more time by shop type, we found that National MSO’s share of volume for the largest carriers is significantly higher than for the remaining carriers. On the other hand, independents’ had the lion’s share of share of DRP volume for carriers outside the top 25 at 72 percent (Figure 16).

But the top 25 insurance carriers will still take the bulk of the market share. Last year, 88 percent Market of U.S. auto insurance direct premiums were underwritten by the top 25 carriers (see Figure 17). On the repair shop side, over 40 percent of 2020’s total repair industry revenue came from shops that had over $10M in annual shop revenue.[8] And, big MSOs appear to also be getting bigger – more than 327 rooftops were acquired in the last two years.[9]

As auto accident frequency continues its recovery to pre-pandemic levels, many of the industry’s challenges still exist. Understanding your individual market conditions, and the potential requirements specific to the vehicles each repairer is most likely to see, and the deciding where to invest in training and tools has become more challenging and expensive. To “win” in 2023, shops should continue to adapt their businesses to address the consumer and market demands, understand the changing and complex vehicle technology, and focus on employee engagement.The information and opinions in this publication are for general information only, are subject to change and are not intended to provide specific recommendations for any individual or entity. Although information contained herein has been obtained from sources believed to be reliable, CCC does not guarantee its accuracy and it may be incomplete or condensed. CCC is not liable for any typographical errors, incorrect data and/or any actions taken in reliance on the information and opinions contained in this publication. Note: Where CCC Information Services Inc. is cited as source, the data provided is an aggregation of industry data related to electronic appraisals communicated via CCC's electronic network or from total loss valuations processed by CCC. [1] CRASH Network. “U.S. has fewer – but larger – shops.” May 23, 2022, Volume 29, No. 19. NADA Data 2021.[2] Auto Care Association. “Auto Care Factbook 2020.” Page 55. Bethesda, MD: 2020.[3] Vincent Romans. “Advancing Our Insights Into The Collision Repair Marketplace.” MSO Symposium presentation, Las Vegas, NV, November 4, 2019[4] Seeking Alpha. “LKQ Corp (LKQ) Q2 Earnings Conference Call July 28, 2022 8:00 AM ET.”[5] TechForce Foundation. “2021 Report” Transportation Technician Supply & Demand.”[6] Ibid.[7] CollisionWeek. “U.S. Department of Labor Projects Auto Body and Glass Employment to Increase Just 3% by 2031.” September 9, 20222.[8] Vincent Romans. MSO Symposium presentation, Las Vegas, NV, November 1, 2021.[9]https://www.autobodynews.com/index.php/industry-news/item/25219-2021-a-busy-year-of-collision-repair-acquisitions.html.