In this issue of CCC Trends we revisit several key topics covered in our Crash Course 2022 publication (in case you missed it, you can download the report here) :

- Changes in driving behaviors and the impact to frequency and severity of auto accidents;

- Supply versus demand imbalances and the impact on U.S. inflation; and

- How labor shortages continue to constrict capacity, drive up wages and alter experiences across nearly all industries.

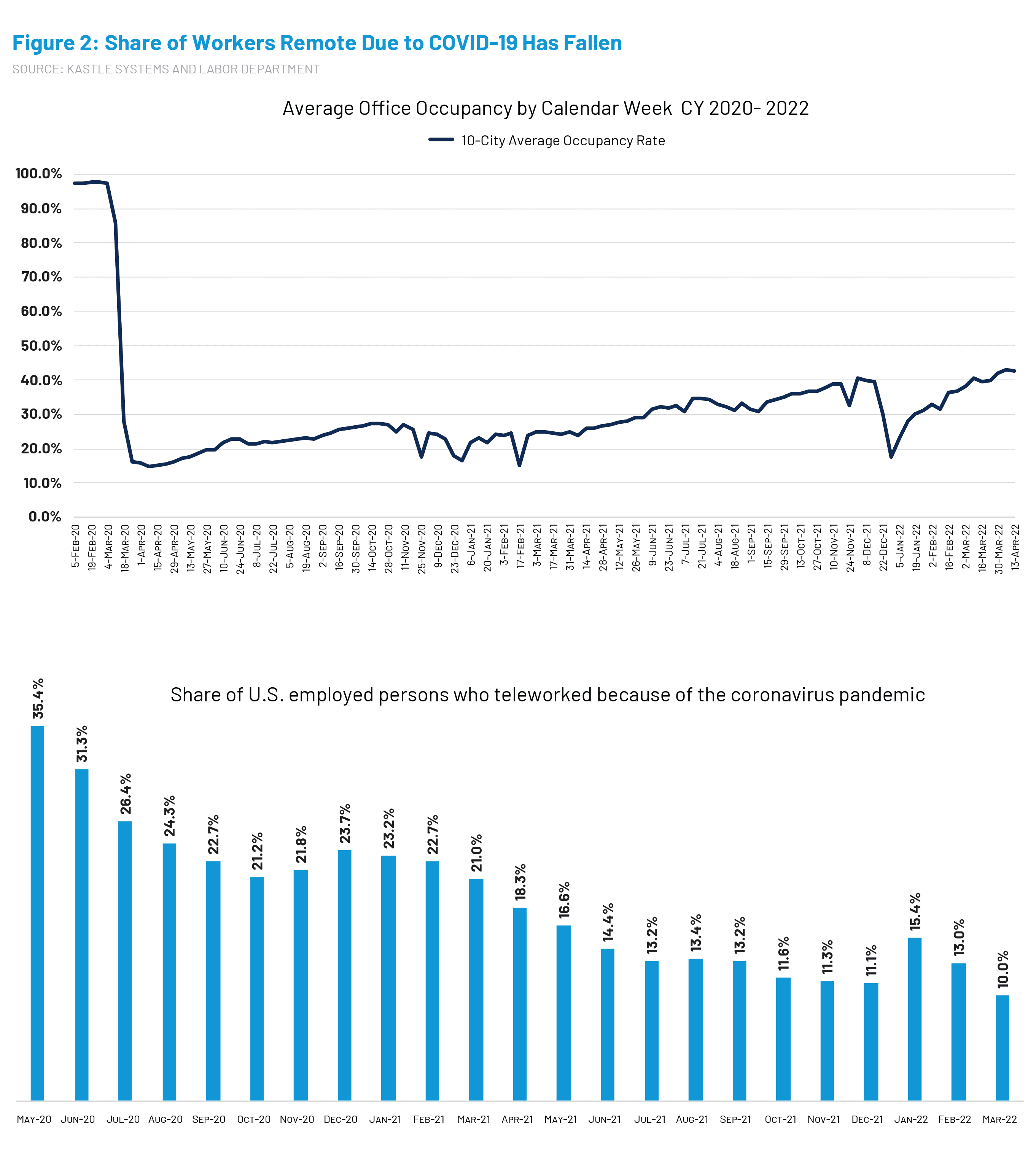

So, let’s get started.Where are we in terms of changes to driving behaviors and the impact to frequency and severity of auto accident?As we approach the second half of 2022, we are beginning to get a better sense of how changes in how and where people are living and working has changed traffic congestion, miles driven, and vehicle accident counts in the U.S. Miles driven overall in the U.S. essentially returned to pre-pandemic levels in the second half of 2021, and despite soaring gas prices, remained near pre-pandemic levels in the first half of 2022 (see Figure 1). We estimate 25% of the workforce is still working remote at least several days per week based on data from several sources. Data from the U.S. Labor Department showing a steady decline in share of workers that teleworked because of the COVID-19 pandemic. Data from numerous analysts suggests nearly 40 percent of jobs in the U.S. could be done remote;[1],[2] and office occupancy data from Kastle Systems over 40 percent as of Q2 2022 (see Figure 2).

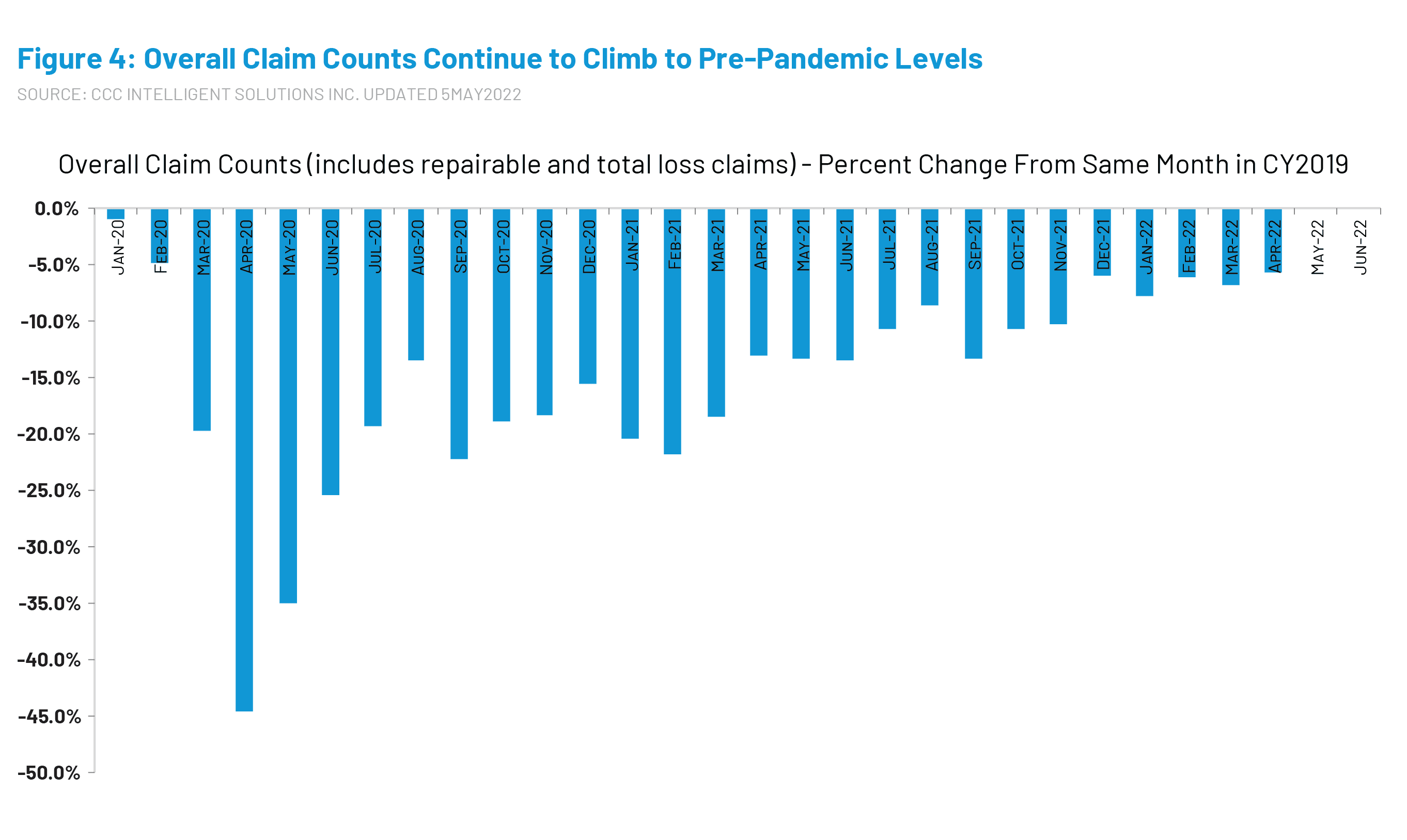

And finally, data from numerous telematics companies and other studies have shown that reduction in travel from home to office has been compensated by additional trips taken for “other reasons during teleworked days”, and instead caused a “spatial, modal and temporal redistribution of demand.”[3] It’s also important to note that 45 percent of people in the U.S. do not have access to any public transit systems where they live.[4] As a result, congestion levels, while building, remain lower than pre-pandemic, and non-driveable claim volume remains elevated as vehicles traveling at higher speeds experience more damage during accident impact (see Figure 3). Overall, auto claim frequency continues to climb closer to pre-pandemic levels (see Figure 4).

What about supply disruptions and inflation?Towards the end of 2021, many automakers forecast their new vehicle production numbers would improve by the second half of 2022, as semiconductor chip shortages would be less severe. Now however, with the Russian invasion of the Ukraine, the cost of oil, diesel, aluminum and other raw materials, neon gas, freight, labor, and more have soared, leading to even further supply chain disruption, and further challenges inhibiting new vehicle production. These higher costs continue to keep new vehicle prices elevated, which combined with low inventory, is holding back new vehicle sales, further pointing to tighter supply of used vehicles in coming years. So, while wholesale used vehicle prices have started to fall (down over 5 percent in April 2022 from the peak in December 2021), the April 2022 Manheim wholesale used vehicle value index was still up over 60 percent from April 2019. This underscores how used vehicle prices, while softening, are still significantly higher than pre-pandemic (see Figure 5) and are not likely to return to pre-pandemic levels anytime soon.

Supply chain issues and inflation continue to drive up vehicle repair costs as well. The average cost per replacement part increased another 5 percent in Q1 2022 versus full year 2021 where the industry experienced an overall increase of 7.4 percent (see Figure 6). In fact, over 50 percent of the increase in average repair costs over the last five years has come from the increase in spend on replacement parts (see Figure 7). Increased vehicle complexity has also played a role as evidenced by further increases in average replacement parts and the declining share of labor spend for repair operations (see Figure 8).

What about labor shortages?The latest data from CRASH Network for Q2 2022 shows nearly 80 percent of collision repair shops in the U.S. are scheduling vehicle repairs out two weeks or more into the future. Parts availability continues to be an issue, but a shortage of technicians is also a key reason. The collision repair industry, like many industries, simply cannot find enough technicians to fill the open positions. In order to retain and attract new talent, repairers have been raising wages: as of Q3 2021, data from the Bureau of Labor shows the average weekly wage of all employees at auto body repair facilities was up 7.2 percent versus the same quarter in 2020 (see Figure 9).[5] These added labor costs are now translating to increased labor rates. Many shops have reported approved rate increases between 6 and 9 percent; a key factor why repair costs are climbing even faster (see Figure 10).[6] With the TechForce Foundation projecting a shortage of nearly 20K collision repair technicians annually between now and 2030,[7] repairer capacity and wages will continue to be a headwind for some time.

The information and opinions in this publication are for general information only, are subject to change and are not intended to provide specific recommendations for any individual or entity. Although information contained herein has been obtained from sources believed to be reliable, CCC does not guarantee its accuracy and it may be incomplete or condensed. CCC is not liable for any typographical errors, incorrect data and/or any actions taken in reliance on the information and opinions contained in this publication. Note: Where CCC Information Services Inc. is cited as source, the data provided is an aggregation of industry data related to electronic appraisals communicated via CCC's electronic network or from total loss valuations processed by CCC.[1] Jonathan I. Dingel, Brent Neiman, How many jobs can be done at home?, Journal of Public Economics, Volume 189, 2020, 104235, ISSN 0047-2727, https://doi.org/10.1016/j.jpubeco.2020.104235. (http://www.sciencedirect.com/science/article/pii/S0047272720300992)[2] IEA (2020), Working from home can save energy and reduce emissions. But how much?, IEA, Paris https://www.iea.org/commentaries/working-from-home-can-save-energy-and-reduce-emissions-but-how-much.[3] Benoit Laine and Coraline Daubresse. “Teletravail et demande de transport: une evaluation dans le modele PLANET.” Novembre 2020. Bureau federal du plan, Working Paper 6-20. https://www.plan.be.[4] https://www.apta.com/news-publications/public-transportation-facts/.[5] https://collisionweek.com/2022/04/07/third-quarter-2021-collision-repair-average-weekly-wages-7-2-compared-2020/.[6] CRASH Network. “Majority of shops reporting labor rate increases.” Volume 29, No. 14, April 18, 2022.[7] TechForce Foundation. “Transportation Technician Supply & Demand: 2021 Report.” P. 9.